Due

to the unique characteristics of coins, the relationship between

cryptocurrencies and inflation is quickly becoming more complex. There is still

a belief in the inflation-resistant qualities of assets associated with Bitcoin

despite arguments to the contrary. This article explores how inflation may

affect the world of cryptocurrencies.

What

Is Inflation?

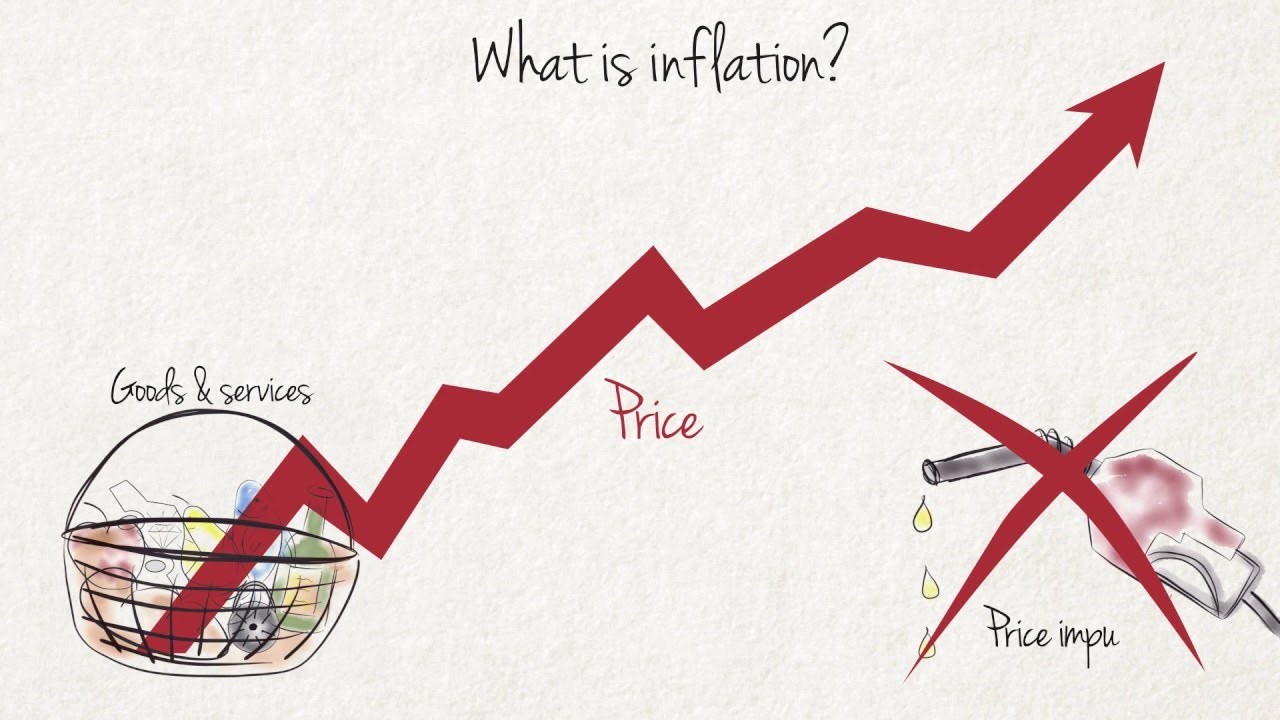

The

typical signs of inflation include an increase in the cost of consumer goods

and a slow decline in the value of currencies. Cryptocurrencies like Bitcoin

often exhibit minimal inflation due to their finite supply.

Image:

Inflation

Hyperinflation

is a condition where the purchasing power of a currency decreases as inflation

increases. Hyperinflation is typically defined as a sustained upward trend in

the costs of goods and services across an economy. As a result, purchasing the

same goods and services requires using more currency units.

Inflation has an impact on all goods and services, including utilities, automobiles, food, healthcare, and housing. Due to the decline in the value of money, both businesses and individuals are affected. Consumers experience decreased purchasing power, decreased savings, and delayed retirement as a result.

Read more:

The

Impact of Inflation on Cryptocurrency

Given

that cryptocurrencies have only been around for a little over a decade,

predicting their impact on inflation is a difficult if not impossible task.

Most of this time saw little to no significant inflation in notable economies.

While

we will explore some current understanding in this article, it may be wise to

seek advice from a financial advisor with knowledge of cryptocurrency investments regarding how to handle inflationary spikes.

1. Cryptocurrency

is not currency

The

first cryptocurrency Bitcoin serves as an example of how cryptocurrencies have

emerged as unconventional assets. Cryptocurrencies work on decentralized networks and rely on cryptography for security. This is unlike fiat currencies

that are issued and governed by governments.

In

this case, the impact of inflation on cryptocurrencies manifests differently.

Bitcoin and many other cryptocurrencies incorporate scarcity principles into

their development. For example, Bitcoin has a fixed supply of 21 million coins,

a feature that limits the possibility of significant inflation. This structure

has led some to view cryptocurrencies as potential hedges against traditional

inflationary trends.

2. Cryptocurrency

is not completely an inflation hedge

Using cryptocurrencies as a protection against inflation is often debated. Real-world situations are more complicated, even though the scarcity element ingrained in their design suggests a degree of protection against traditional inflationary pressures.

In the past, cryptocurrencies have experienced large price fluctuations that have been influenced by things like market sentiment, legislative changes, technological advancements, and general economic trends. Although their design is based on scarcity, which theoretically could offer some resilience, it does not ensure immunity from the complex forces that affect their valuation.

Image: Hedge against inflation

3. Investors

have a role to play

As

the world of cryptocurrencies and inflation intersect, investors find

themselves at a crossroads. A strategic approach to risk management is

necessary due to the inherent volatility of cryptocurrency markets, which can

magnify both gains and losses. Investors need to understand the subtle

differences between traditional economic indicators and the unique features of

cryptocurrencies.

Some

investors have turned to cryptocurrencies as a speculative alternative or

potential haven during times of economic decline. Nevertheless, it is important

to understand that while some features of cryptocurrencies may line up with features

that are resistant to inflation, they are still subject to the dynamics of the

larger financial system.

Conclusion

Since

there is currently no trading history for cryptocurrencies during periods of

inflation, it is impossible to accurately predict how prices will change as a

result. Given the risks of cryptocurrency investment irrespective of market

conditions, collaborating with a cryptocurrency-experienced financial advisor

becomes vital to navigate investment timing decisively.

Due to the unique characteristics of coins, the relationship between cryptocurrencies and inflation is quickly becoming more complex. There is still a belief in the inflation-resistant qualities of assets associated with Bitcoin despite arguments to the contrary. This article explores how inflation may affect the world of cryptocurrencies.

Written by Sam